2022 Prosecutors entered into evidence a promissory note written that day by Avenatti for a $300,000 loan from Macias’ contact.Īndrea Marks, Rolling Stone, 26 Jan. 2022 The remaining $150 million is a promissory note with the first payment due in three years. Vide Bank note Note Reissuable note.Recent Examples on the Web The letter of credit eventually evolved into the bill of exchange, or promissory note, between banks, used for business transactions.Īmanda Foreman, WSJ, 17 Mar. Although a simple contract, a sufficient consideration is implied from A promissory note payable to order or bearer passes by indorsement,Īnd although a chose in action, the holder may bring suit on it in his own Though it has been held differently in the state of New York. 382.Īnd, secondly, it is required that it be for the payment of money only 10

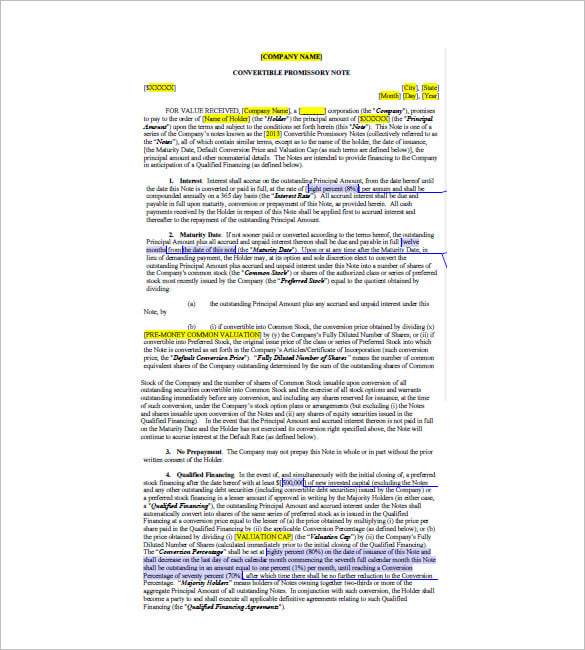

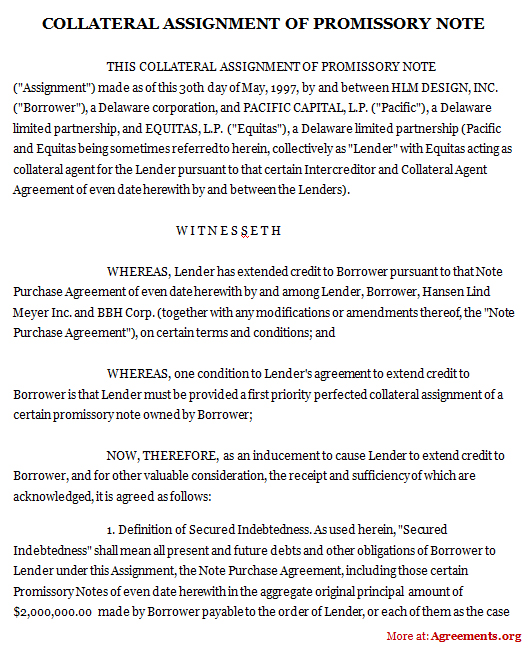

132 nor payable out of any particularįund. Note first, that it be payable at all events, not dependent on anyĬontingency 20 Pick. There are two principal qualities essential to the validity of a Promise to deliver the money, or to be accountable for it, or that the payee No particular form is requisite to these instruments a Most of the rules applicable to bills of exchange, equally affect The acceptor and the indorsee, the payee. The indorser is as it were the drawer the maker, To one for then it is an order by the indorser of the note upon the maker Resemblance to a bill of exchange yet, when indorsed, it is exactly similar Although a promissory note, in its original shape, bears no He who makes the promise is called the maker, and he to whom it is In its form it usually contains a promise to pay, at a time thereinĮxpressed, a sum of money to a certain person therein named, or to his Without any promise to pay, as when the debtor gives his creditor an I 0 U. A promissory note differs from a mere acknowledgment of debt, A written promise to pay a certain sum of money,Īt a future time, unconditionally. (See: interest, obligor, obligee, usury)Ĭollins Dictionary of Law © W.J. A promissory note need only be signed and does not require an acknowledgement before a notary public to be valid. When the amount due on the note, including interest and penalties (if any) is paid, the note must be cancelled and surrendered to the person(s) who signed it. Charging a rate in excess of the legal limit is called "usury," and this excess is legally uncollectible.

There are legal limitations to the amount of interest which may be charged. The promissory note is usually held by the party to whom the money is owed.

PRINCIPAL DEFINITION PROMISSORY NOTE FULL

A promissory note may contain other terms such as the right of the promisee to order payment be made to another person, penalties for late payments, a provision for attorney's fees and costs if there is a legal action to collect, the right to collect payment in full if the note is secured by real property and the property is sold ("due on sale" clause), and whether the note is secured by a mortgage or deed of trust or a financing statement (a filed security agreement for personal collateral). The specified time of payment may be written as: a) whenever there is a demand, b) on a specific date, c) in installments with or without the interest included in each installment, d) installments with a final larger amount (balloon payment). a written promise by a person (variously called maker, obligor, payor, promisor) to pay a specific amount of money (called "principal") to another (payee, obligee, promisee) usually to include a specified amount of interest on the unpaid principal amount (what he/she owes). West's Encyclopedia of American Law, edition 2. The purchaser of a discounted promissory note often receives interest in addition to the appreciated difference in the price when the note is held to maturity. The notes can be subsequently redeemed on the date of maturity for the entire face amount or prior to the due date for an amount less than the face value. A promissory note can be either payable on demand or at a specific time.Ĭertain types of promissory notes, such as corporate bonds or retail installment loans, can be sold at a discount-an amount below their face value. It contains an unconditional promise to pay a certain sum to the order of a specifically named person or to bearer-that is, to any individual presenting the note. If signed by the maker, a promissory note is a negotiable instrument. The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. A written promise to pay money that is often used as a means to borrow funds or take out a loan. A written, signed, unconditional promise to pay a certain amount of money on demand at a specified time.

0 kommentar(er)

0 kommentar(er)